Table of Contents

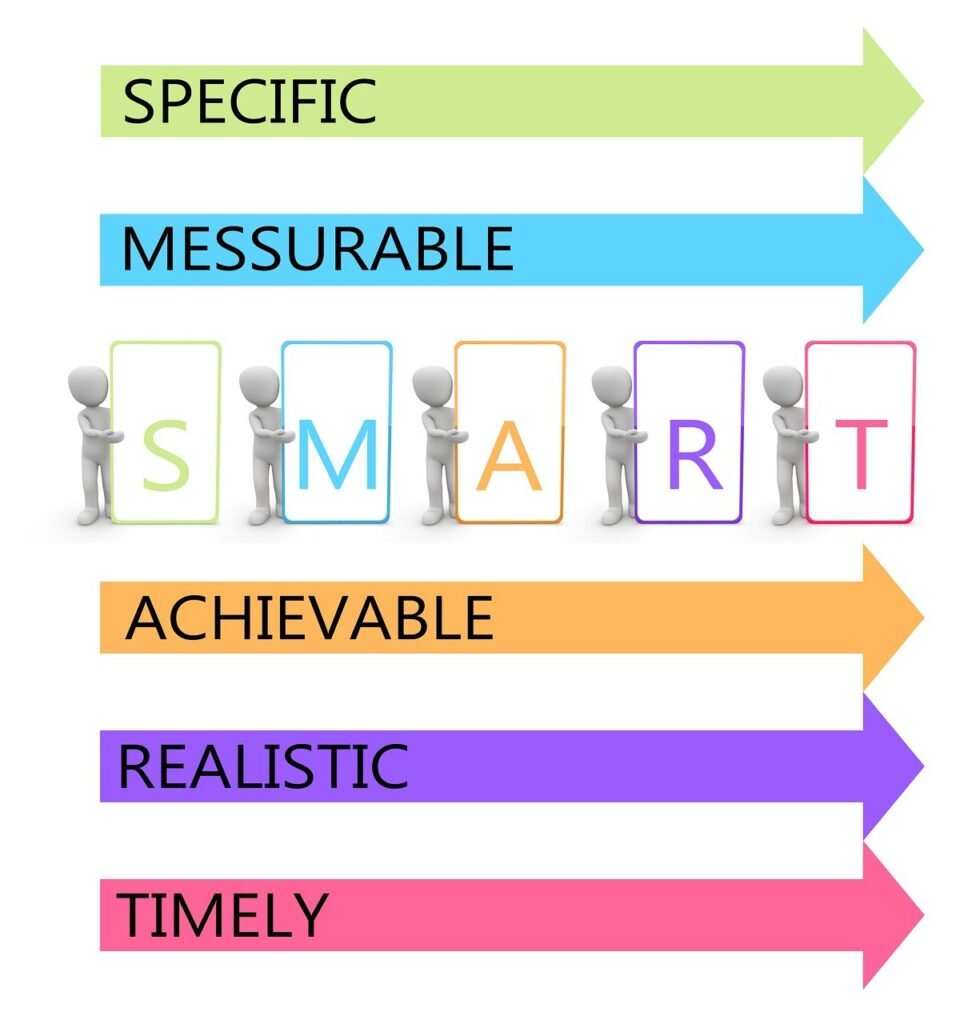

The New Year brings with it a sense of renewal and the perfect opportunity to reassess your financial priorities. Using the SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—you can transform vague resolutions into actionable and achievable goals. It’s a time to dream big but also to plan wisely. Many people resolve to improve their finances, whether it’s by saving more, investing smarter, or reducing debt. Yet, these aspirations often fall by the wayside because they lack structure.

By adopting this proven strategy, you can turn your ambitions into tangible results. This method not only makes your goals clearer but also empowers you to stay on track and build confidence with every milestone you achieve. Here’s how you can embrace this powerful strategy to set and achieve your financial goals for the New Year:

Here’s how you can embrace this powerful strategy to set and achieve your financial goals for the New Year:

1. Be Specific

Vague goals like “saving more money” or “paying off debt” are harder to achieve because they lack direction. To make your goal effective, clearly define what you want to accomplish and why it matters. The more detailed your goal, the easier it is to stay focused and motivated.

- Example: “Save $5,000 for a vacation by December 31st.”

- Why it works: You know exactly what you’re saving for, how much you need, and when you need it by. A well-defined purpose—such as creating lasting memories with loved ones—adds an emotional connection that makes sticking to the goal even more rewarding.

START YOUR BUSINESS IN 2025 WITH OUR E-BOOK “STARTUP”

Startup: Turning Dreams into Reality is a practical and inspiring guide for aspiring entrepreneurs and startup founders. Covering everything from developing a winning mindset to securing funding and scaling your business, this e-book provides actionable strategies, real-life case studies, and exclusive resources. It’s the ultimate toolkit to turn your business vision into a reality. Dive in and start your entrepreneurial journey with confidence!

2. Make It Measurable

A measurable goal helps you track your progress and stay motivated along the way. Numbers and milestones provide clarity, ensuring you’re aware of how far you’ve come and what’s left to achieve. This precision allows for real-time adjustments if needed.

- Example: “Increase monthly savings by $200 starting in January.”

- Why it works: You can easily measure whether you’ve saved the extra $200 each month. Seeing consistent progress reinforces your confidence and keeps you on track, proving that small steps can lead to significant outcomes over time.

3. Ensure It’s Achievable

While it’s great to aim high, overly ambitious goals can lead to frustration and disappointment. To stay motivated, set goals that stretch you just enough without being unrealistic. Consider your current financial situation and identify practical ways to make your goal attainable.

- Example: “Pay off $3,000 of credit card debt in six months.”

- Why it works: Based on your income and expenses, you’ve determined this is doable with some adjustments. Achieving realistic goals builds momentum and confidence, paving the way for even bigger accomplishments in the future.

4. Keep It Relevant

Your financial goals should align with your values and long-term priorities. Ask yourself why the goal is meaningful and how it contributes to your bigger picture. When a goal resonates with your personal aspirations, you’re more likely to stay committed.

- Example: “Save $10,000 for a home down payment in the next two years.”

- Why it works: If owning a home is a priority, this goal directly supports that ambition. By focusing on goals that matter most to you, you’re investing your time and energy into something deeply rewarding, making the journey worthwhile.

5. Set a Time Frame

Deadlines create urgency and provide a clear endpoint to work toward. Without a time frame, it’s easy to procrastinate or lose sight of your objectives. By setting a specific timeline, you establish a sense of accountability and drive to achieve your goal.

- Example: “Build a $1,000 emergency fund within three months.”

- Why it works: The timeline encourages immediate action and consistent progress. Deadlines act as motivational milestones, helping you break your larger goal into manageable tasks that keep you moving forward at a steady pace.

Putting It All Together: An Example SMART Goal

Let’s break down a SMART goal:

- Specific: Save $5,000 for a family vacation. Define the purpose of the goal clearly—a family vacation is a meaningful reason to save that motivates action.

- Measurable: Save $417 per month. Breaking the goal into monthly savings makes it easier to track progress and adjust as needed.

- Achievable: Adjust budget by reducing dining out and entertainment expenses. Evaluate your current spending habits and identify areas where you can cut back without compromising essential needs.

- Relevant: Prioritize family experiences over non-essential spending. Align your financial efforts with personal values, making the goal feel rewarding and worthwhile.

- Time-bound: Achieve the goal by December 31st. Having a clear deadline instills urgency and keeps you focused on meeting your target step by step.

Common Mistakes to Avoid

Setting financial goals is an essential step toward achieving financial stability and success, but many people encounter common obstacles that derail their efforts. Recognizing these pitfalls and knowing how to overcome them can make a significant difference in reaching your objectives. Here are some common mistakes and strategies to avoid them:

1. Being Overly Vague:

Goals like “I want to save money” or “I’ll start investing someday” lack clarity and direction. Without specifics, it’s challenging to measure progress or stay motivated. To overcome this, clearly define your objectives. Replace vague intentions with detailed goals, such as “Save $10,000 for a down payment by December 2025.” The more specific your goal, the more actionable it becomes.

2. Setting Unrealistic Targets

Ambitious goals are inspiring, but if they’re not grounded in reality, they can lead to frustration and abandonment. For example, aiming to save half your income when you’re living paycheck-to-paycheck is likely impractical. Instead, assess your current financial situation and set goals that challenge you while remaining attainable. Start small and build momentum over time.

3. Neglecting a Time Frame:

Goals without deadlines can easily fall by the wayside. A timeline creates a sense of urgency and helps prioritize actions. If you plan to build an emergency fund, decide on a specific completion date, such as “Save $1,500 in six months.” Breaking your timeline into monthly or weekly milestones keeps your goal.

4. Ignoring the “Why” Behind Your Goals:

Without a clear purpose, it’s easy to lose motivation. Ask yourself why this goal is important. For example, saving for retirement might mean ensuring a comfortable lifestyle for your future self. When your goals align with your values and priorities, they become more meaningful and easier to stick to.

5. Failing to Track Progress:

It’s impossible to know if you’re on track without monitoring your efforts. Ignoring progress can lead to oversights and missed opportunities for adjustment. Use budgeting apps, spreadsheets, or even a simple notebook to regularly review your progress. Celebrate small wins to stay motivated and committed.

By addressing these common pitfalls, you can set yourself up for success. Remember, effective financial goal-setting isn’t just about what you want to achieve but also about creating a realistic and structured plan to get there.

Build your confidence and succeed in achieving your goals.

Buy the Best Seller E-Book on Confidence building to Achieve your GOALS

Discover your unique path to confidence with The Introvert’s Confidence Code. This empowering guide helps introverts build authentic self-assurance through self-awareness, quiet strength, and practical strategies. Learn how to embrace your introverted qualities, communicate confidently, and lead with ease in both social and professional settings. Step into a new level of self-confidence—on your own terms.

Tips for Staying on Track

- Automate Your Savings: Set up automatic transfers to your savings account to ensure consistency. Automating your savings takes the guesswork out of financial planning. By doing this, you ensure that a portion of your income is allocated towards your goals without needing constant reminders. Over time, this simple habit can lead to significant savings without feeling the pinch of manual contributions.

- Track Your Progress: Use apps or spreadsheets to monitor your progress regularly. Staying on top of your progress can boost motivation and help you identify potential setbacks early. Financial tracking tools provide real-time insights into your spending and saving patterns, making it easier to make informed adjustments to stay on course.

- Adjust as Needed: Life happens—if unexpected expenses arise, reassess your goals and timeline. Flexibility is crucial when it comes to financial planning. Whether it’s an emergency car repair or a medical bill, unforeseen expenses can derail your plans temporarily. By periodically reassessing your financial goals, you can adapt to changing circumstances while staying committed to the bigger picture.

- Celebrate Milestones: Reward yourself for hitting smaller targets to stay motivated. Achieving smaller financial goals deserves recognition. Treat yourself within reason—a dinner out or a small gift—as a reward for hitting milestones. This helps maintain enthusiasm and reminds you of the progress you’ve made, no matter how incremental it may seem.

Conclusion

Setting SMART financial goals for the New Year can help you create a clear and actionable plan for your money. By being specific, measurable, achievable, relevant, and time-bound, you’re more likely to stay focused and succeed. Remember, small, consistent efforts can lead to significant progress over time. Don’t be discouraged by setbacks; instead, use them as learning experiences to refine your strategies. The journey to financial success is a marathon, not a sprint. Take some time to reflect on your priorities, commit to your goals, and start taking actionable steps today. Your future self will thank you for the discipline and foresight you demonstrate now. Embrace the challenge and celebrate the rewards that come with achieving financial freedom!

Frequently Asked Questions (FAQs)

What are SMART financial goals?

SMART financial goals are objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps you clearly define your goals and provides a structured way to track and achieve them.

Why is it important to set financial goals for the New Year?

The New Year offers a fresh start and an opportunity to reassess your priorities. Setting financial goals during this time helps you plan for the year ahead, stay focused, and work towards long-term financial stability.

How do I make my financial goals realistic?

To make your financial goals realistic, consider your current financial situation, income, and expenses. Break down larger goals into smaller, manageable steps and set timelines that are challenging yet attainable.

What are some common mistakes people make when setting financial goals?

Some common mistakes include setting vague goals, being overly ambitious, ignoring deadlines, and failing to track progress. Addressing these pitfalls by using the SMART framework can significantly improve your success rate.

Can I adjust my financial goals if circumstances change?

Absolutely! Flexibility is key to successful financial planning. If unexpected expenses or changes occur, reassess your goals and timelines to accommodate the new situation without losing sight of your overall objectives.

How can I track my progress effectively?

You can track your progress using budgeting apps, spreadsheets, or simple tools like notebooks. Regularly reviewing your progress helps identify areas for improvement and keeps you motivated.

What should I do if I miss a milestone or fall behind on my goal?

If you miss a milestone, don’t get discouraged. Reassess your plan, identify the reasons for the setback, and adjust your approach. Remember, setbacks are part of the journey, and persistence is key.

Is it necessary to have a deadline for financial goals?

Yes, having a deadline creates a sense of urgency and helps prioritize your efforts. Timelines also make it easier to track progress and stay accountable.

How can I stay motivated to achieve long-term financial goals?

Staying motivated involves celebrating small milestones, aligning your goals with your values, and keeping track of your progress. Visualizing the outcome and its impact on your life can also provide a motivational boost.

What tools or resources can help me set and achieve financial goals?

Budgeting apps, financial planners, savings calculators, and books on personal finance are excellent resources. You can also consult with a financial advisor for personalized guidance.